When it comes to car insurance, numerous drivers often ponder how their premiums are calculated. The process can feel complex, with different factors affecting the rates you pay. Understanding the details of auto insurance pricing can empower you to take knowledgeable decisions when seeking coverage.

Insurance companies use a combination of data analysis and statistical modeling to establish your rates. This involves considering your personal information, driving history, and even the type of vehicle you own. By diving into the details, we can uncover the factors that contribute to calculating those rates and how you can to potentially lower them.

Factors Affecting Insurance Premiums

When determining determining your car insurance premiums, multiple key factors come into play. One of the main considerations is your driving record. A no-claim record with no accidents or traffic violations typically signals to insurers that you are a reduced risk, leading to more favorable premium rates. On the contrary, if you have accidents or speeding tickets on your record, you may end up facing higher premiums as insurers perceive you as a greater risk on the highway.

A further significant factor is the geographic location. Insurance companies assess the area where you live and drive to determine the chances of accidents, theft, or vandalism. Urban areas often have elevated crime rates and more traffic congestion, which can lead to greater insurance costs. On the other hand, rural areas might see lower premiums due to fewer traffic and lesser claims, reflecting a reduced risk to the insurer.

Your characteristics also play a crucial role in calculating the premium. Factors such as age, gender, and marital status can impact rates. Younger drivers, particularly males, often face higher insurance costs due to statistical data showing they are at greater risk of accidents. Married individuals or older drivers may have lower rates as they are generally seen as more responsible. In addition, the type of vehicle you drive and its safety ratings can also affect your insurance costs.

A Function of Insurance Underwriting

Underwriting is an essential aspect in establishing car insurance rates, serving as the means by which insurance companies evaluate the risk of covering a certain driver. When you seek auto insurance, underwriters review various factors, including your driving history, credit score, and the make of vehicle you drive. This evaluation helps insurance companies forecast potential claims and set pricing accordingly. A favorable driving record with minimal incidents or violations often leads to minimal rates, while a history of claims can lead to higher costs.

In addition to specific driver data, underwriting also evaluates external factors such as geographic location and market trends. For instance, a driver residing in an area with a elevated incidence of accidents may encounter increased insurance rates. cheapest car insurance near me in the make and model of the vehicle, as specific cars are more prone to theft or expensive to repair, impacting the overall risk. These detailed assessments guarantee that rates reflect an appropriate level of risk for each policyholder.

Moreover, underwriting processes have changed with tech advancements. Insurers now leverage sophisticated algorithms and data analytics to improve their assessments and increase accuracy. This advancement allows for a more personalized approach in setting premiums, making it possible for insurers to offer attractive rates while ensuring profitability. Overall, underwriting is a essential role that balances the interests of both insurer and the insured, eventually influencing the environment of car insurance pricing.

How to Reduce Your Car Insurance Rates

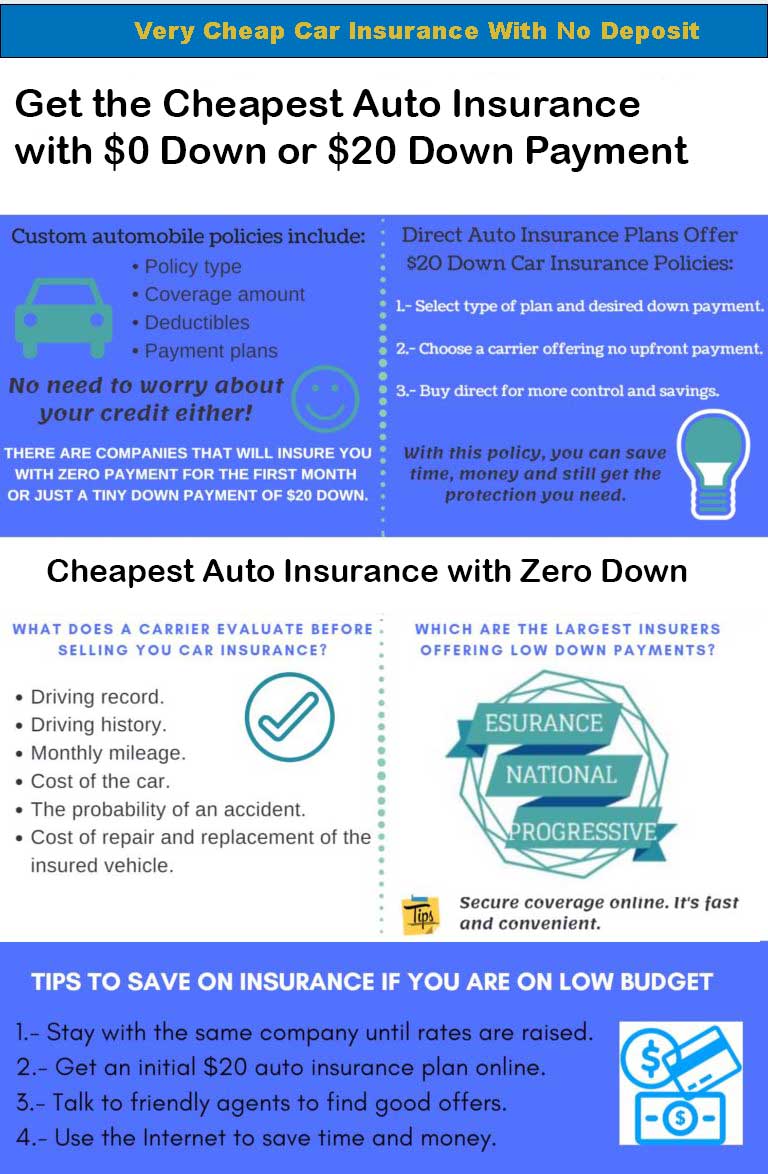

One effective way to reduce your car insurance rates is by comparing prices for the most affordable deals. Insurance companies offer a variety of rates depending on multiple factors such as your driving history, vehicle type, and location. By comparing quotes from various providers, you can find a plan that provides the same coverage for a lower price. It’s beneficial to check for discounts that some insurers give, such as those for cautious driving, bundling policies, or if you are member of particular organizations.

An additional strategy to lower your auto insurance costs is to increase your deductible. The deductible is the sum you pay out of pocket before your insurance kicks in for a claim. By selecting a higher deductible, you can typically reduce your monthly premium. However, it is crucial to ensure that the deductible you choose is an amount you can readily afford in the event of an accident. Finding a balance between your deductible with your overall coverage needs is key.

Finally, considering your car's safety features and its insurance rating can significantly influence your rates. Vehicles equipped with high-tech safety features, such as anti-lock brakes, airbags, and anti-theft systems, often are eligible for discounts. Additionally, opting for a car model that has a established track record of safety and reduced repair costs can lead to lower premiums. When purchasing a vehicle, it’s advantageous to research its insurance ratings and choose one that will help you save on auto insurance.