Finding budget-friendly car insurance can sometimes appear as if a challenging task. However, travelling through the landscape of inexpensive car insurance may result in considerable savings while still offering the protection you require on the road. In today's economy, where every dollar counts, understanding the advantages of affordable auto insurance is more important than ever for drivers seeking to manage their expenses without compromising safety.

A lot of people often associate low premiums with poor coverage, but that is not necessarily true. With a small amount of research and the right strategy, you can get cheap car insurance that fulfills your needs. This article will analyze the benefits of choosing budget-friendly options, how to locate the best deals, and why investing a small amount of time in comparing policies can bring about financial relief. Whether you are a seasoned driver or a inexperienced car owner, grasping affordable car insurance is crucial for making knowledgeable financial decisions.

Understanding Affordable Auto Insurance

Cheap car insurance aims to be intended to deliver essential coverage at a reduced price, making it an appealing alternative for a multitude of vehicle owners. This type of insurance generally offers the basic protection compulsory by law, such as liability for personal injury and property destruction. Though it may not feature wide-ranging supplementary coverage like full or accident insurance, it can still protect drivers from significant financial risk in the occurrence of an accident.

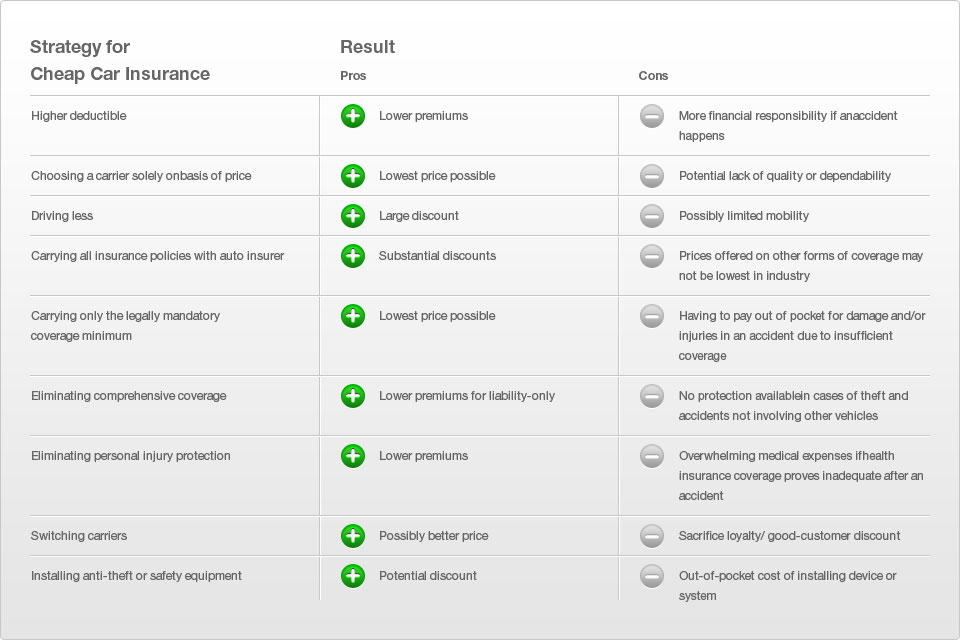

The of the key components resulting to lower costs is the degree of coverage you opt for. By choosing a policy that meets only the minimum state criteria, you can cut expenses on regular installments. However, it is crucial to consider the benefits and disadvantages of minimal coverage, as possessing merely the lowest level may leave you exposed to higher out-of-pocket expenses in the case of a major incident or damage to your vehicle.

Another way to secure affordable vehicle insurance is by capitalizing on discounts available by insurance companies. A variety of providers offer discounts for careful driving, low overall mileage, bundling plans, and even taking defensive driving classes. By being diligent and looking into numerous savings opportunities, drivers can additionally lower their coverage payments without jeopardizing their total protection.

Assessing Protection Companies

When searching for cheap automobile coverage, it is essential to compare multiple insurance providers to find the most suitable coverage that suits your preferences. Various companies offer diverse rates and coverage packages, which can materially affect your overall costs. To make an informed choice, commence by obtaining estimates from various providers. Many insurers provide for easy internet quotes, which can conserve you energy and give you a clearer view of your possibilities.

Invest the effort to examine both the premiums but also the coverage limits and out-of-pocket costs associated with each coverage. At times an company may offer a discounted rate but constrain protection in ways that could lead to costs you more in the future. Grasping the fine print is important, as it makes sure you are evaluating like-for-like and are aware of any exclusions or conditions that may affect.

Finally, take into account the standing and assistance of each coverage insurer. Low-cost auto coverage is not just about the price; you want a service that responds quickly to claims and offers good support when you seek help. Seek out customer reviews, assessments, and any feedback regarding claim processes to identify which providers are dependable and trustworthy.

Aspects Affecting Auto Policy Rates

In regard to calculating vehicle coverage premiums, multiple aspects are involved. Underwriters evaluate the history of the applicant, notably any past accidents as well as violations. A pristine record often leads to diminished rates, but a claim history may raise expenses. Additionally, the kind of vehicle being insured significantly affects the premium. High-performance cars generally cost more to insure due to their increased maintenance expenses and appeal to criminals.

A further important consideration influencing auto coverage rates is the place of the policyholder. Urban areas with higher traffic congestion and crime rates tend to have higher insurance costs compared to rural areas. Insurance companies also consider the likelihood of accidents in certain areas, as this data aids them calculate the potential risk and make more informed pricing choices. Therefore, a person located in a metropolitan area could pay more for coverage than someone in a quieter region.

Ultimately, demographic considerations such as age, gender, and marital status can impact insurance rates. Younger motorists, particularly those under 25, are frequently assessed increased premiums due to inexperience while driving. On the other hand, older drivers can enjoy lower premiums, particularly if they have developed a substantial track record of safety. Relationship status can also play a role, as married individuals tend to obtain discounts for being considered lower-risk motorists. Understanding these influencing factors can help consumers find their quest for cheap auto coverage.

Tips for Finding Inexpensive Coverage

When hunting for low-cost car insurance, it's important to contrast quotes from different providers. Start by gathering car insurance estimates from different companies, as rates can vary considerably. Use online comparison tools or speak with an insurance agent to evaluate different options. This process allows you to find the most advantageous prices and coverage options that meet your needs.

Another efficient way to reduce your premiums is to leverage available savings. Many insurance companies offer discounts for various reasons, such as having a clear driving record, bundling policies, or even completing a defensive driving course. Be sure to inquire about all possible discounts when obtaining quotes, as these can greatly reduce your overall costs.

Lastly, consider adjusting your coverage levels to find a more affordable option. Assess your needs and determine if you can opt for a increased deductible or limit optional coverages that may not be required for your circumstance. Balancing adequate protection with savings can help you find the right cheap car insurance that matches both your budget and coverage requirements.

The Importance of Insurance Coverage Limits

When shopping for cheap car insurance, grasping coverage limits is crucial. Coverage limits refer to the maximum amount an insurance company will pay for a covered loss. Setting appropriate limits ensures that you are adequately protected in the event of an incident. Choosing too low a limit can lead to personal expenses, which can be monetarily devastating. Achieving the right balance between an reasonable premium and adequate coverage is essential to safeguard your assets.

Moreover, different states have different minimum coverage requirements. It is crucial to be aware of these regulations to avoid penalties and ensure adherence. However, meeting the bare minimum may not always provide sufficient protection, especially if you are involved in a major accident. Evaluating your personal circumstances, including your vehicle's value and your financial situation, will help you determine whether you need increased limits for improved security.

Finally, keep in mind that selecting higher coverage limits typically results in a increased premium. However, the assurance that comes from knowing you are fully protected can offset the additional costs. It's vital to review your policy regularly and modify your coverage limits to reflect any changes in your life, such as the acquisition of new assets or changes in earnings. Making educated decisions about your coverage limits can increase your savings while ensuring that you are not left exposed on the road.

Common Fallacies about Affordable Insurance

A lot of people think that affordable car insurance means compromising on coverage. This is a widespread fallacy, as cheaper premiums can still offer substantial protection. In truth, insurers have a range of policies at multiple price points, and it is possible to find budget-friendly options that likewise cover necessary aspects like liability, collision, and full insurance. Thoroughly evaluating policies will often reveal that you can obtain solid insurance without stretching your budget.

An additional myth is that low-cost auto insurance is only available to responsible drivers. Although having a clean driving record can lead to more beneficial rates, it's not the only determinant of pricing. Many insurers take into account various factors such as your residence, automobile type, and even your credit history. As a result, individuals with less-than-perfect records or varied driving histories can still locate cheap policies if they explore various providers and consider multiple companies.

In conclusion, there is a belief that if an insurer delivers cheap policies, their service is poor. Nevertheless, cheap car insurance near Fort Worth, TX and maintain high-quality service standards. Investigating customer reviews and ratings can offer insight into the experiences of others with specific insurers. Often, those who opt for inexpensive plans experience surprisingly excellent support and assistance, proving that low cost does not automatically correlate with inferior service.

Tips for Change Your Policy for Savings

Changing your insurance policy may lead to substantial savings on your premium. Commence by reviewing your current coverage. It's important to find out if you need every the features included within the plan. As an example, if you have an older vehicle, you might consider dropping collision or comprehensive coverage, as the cost of repairs may surpass the benefits of insurance coverage. A thorough assessment of the needs will help you identify areas where you can lower costs.

One more handy tip is to boost your deductibles. Choosing a higher deductible typically reduces your monthly premium, resulting in quick savings. However, it’s vital to make sure that you can manage to pay the higher deductible in the case of a claim. This adjustment can be particularly beneficial for those who have a track record of careful driving and are not as likely to submit regular claims.

In addition, think about combining your cheap auto insurance with other types of policies, like home or renters insurance. Many insurers give discounts for bundling, which can result to further savings. Don’t be reluctant to ask the insurance provider about any additional discounts you may qualify for, including those related to safe driving, good student status, or low mileage. Taking these adjustments can result to a cheaper and more customized insurance experience.

Real-Life Savings: Customer Experiences

Many drivers have discovered the considerable monetary relief that comes with transitioning to affordable car insurance. Look at the case of Sarah, a single mother from Texas. After researching and comparing various options, she found a policy offering extensive coverage at a fraction of her previous premium. The savings she saved not only aided her manage monthly expenses better but also enabled her to invest to her children's education fund. This experience highlighted how low-cost insurance can lead to more than just savings; it can bolster a family's future.

In a similar vein, a college student, shared how selecting cheap auto insurance was beneficial during his school years. With restricted income from temporary jobs, he couldn’t afford expensive premiums. By choosing an affordable policy that still met all legal requirements, he was able to allocate the leftover money for necessary items like textbooks and supplies. Tom understood that operating his vehicle responsibly and choosing the right coverage allowed him to concentrate on his studies without worrying about monetary strain.

Finally, Jane and Mark, a couple who frequently travel for work, considered their switch to cost-effective insurance. Initially skeptical about the trade-offs in coverage, they were positively surprised by the standard of service they obtained. Not only did their insurance rates drop substantially, but they were also able to utilize extra services like roadside assistance without a rise in costs. Their journey highlighted a valuable lesson: finding cheap car insurance does not imply sacrificing protection; it can enhance how families manage their finances and enjoy life’s adventures.